In terms of acquiring a car or truck, many people think about the selection of buying from a used car dealership. This choice is commonly determined by the will to save money, as used cars and trucks commonly appear at a cheaper price place than brand name-new ones. A highly regarded applied auto dealership offers a wide selection of cars which have been thoroughly inspected and so are Prepared for resale. This offers customers reassurance knowing the vehicle These are investing in has gone through arduous checks to be sure its trustworthiness. The charm of made use of vehicles is not merely limited to their affordability; Furthermore, it extends to The variability of versions out there, enabling people to locate a vehicle that fulfills their unique requirements and Choices. Irrespective of whether somebody is looking for a compact car or truck for town driving or a bigger SUV for family outings, a employed auto dealership is probably going to obtain several choices that suit the Invoice.

The entire process of getting a car or truck from the applied motor vehicle dealership often involves the necessity for motor vehicle financial loans. These financial loans are vital for individuals who don't have the implies to pay for a car outright. Many used motor vehicle dealerships give funding alternatives to produce the acquiring procedure smoother for his or her shoppers. Auto loans are generally structured in a means that allows potential buyers to repay the cost of the auto after a while, making it a lot easier to control financially. Fascination prices on car loans will vary depending on the customer's credit historical past, the loan expression, and the lender. It is important for potential customers to cautiously look at the conditions in the financial loan prior to committing, as this could have a significant impact on their fiscal obligations in the a long time to come back.

For people with a considerably less-than-great credit history history, securing financing by means of terrible credit history car financial loans might be required. Negative credit rating auto loans are exclusively intended for people who definitely have struggled with credit rating difficulties in past times. These financial loans normally feature increased curiosity charges as a result of improved danger perceived by lenders. Nevertheless, they provide a possibility for individuals with negative credit to rebuild their credit history rating although nonetheless getting the car or truck they need to have. When working with a made use of auto dealership, it is not unheard of to search out financing solutions customized to support prospective buyers with negative credit history. These dealerships recognize the difficulties confronted by people with weak credit score and infrequently spouse with lenders who specialise in negative credit history vehicle financial loans, making sure that a lot more folks have access to the automobiles they have to have.

Yet another significant consideration when acquiring a made use of vehicle is the potential for auto refinancing. Car refinancing makes it possible for motor vehicle owners to exchange their recent car personal loan having a new one particular, most likely securing improved conditions for instance a lower interest price or a more manageable month-to-month payment. This can bad credit car loans be especially helpful for individuals who originally took out negative credit score automobile loans but have because enhanced their credit history rating. By refinancing, they might be able to decrease their monetary burden and save money around the lifetime of the bank loan. Employed vehicle dealerships often do the job with refinancing professionals to aid their clients discover these solutions. The target of motor vehicle refinancing is to create car ownership more very affordable and sustainable in the long term, allowing persons to maintain their money wellness while even now taking pleasure in the benefits of possessing a car or truck.

Inside the made use of vehicle current market, the availability of varied funding solutions, which includes car or truck financial loans and poor credit score car or truck financial loans, is essential for making certain that a wide array of potential buyers can access the automobiles they need used car dealership to have. Applied car dealerships Perform a substantial position in facilitating these transactions by presenting adaptable funding methods and partnering with lenders who will be prepared to do the job with customers of all credit backgrounds. The choice to go after car or truck refinancing further more boosts the charm of shopping for from a made use of car dealership, as it offers a pathway for buyers to further improve their financial problem eventually. By thoroughly looking at all of these factors, individuals may make knowledgeable decisions when bad credit car loans purchasing a applied auto, making certain which they uncover the correct vehicle in a cost they can find the money for.

Neve Campbell Then & Now!

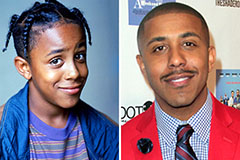

Neve Campbell Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Tyra Banks Then & Now!

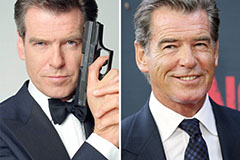

Tyra Banks Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!